Date of Birth. A late payment interest rate of 6 per year is imposed for each day such contribution is not paid on time.

Epfo Subscribers Get More Time To Complete E Nomination Process Details Here

The following is a step-by-step guide to changing your EPF name online.

. EPF Contributions at Malaysiapdf. EPF payment due date is the date by which PF from the employees salary should be deducted. It also lists the supporting banks and the link to them where the payment can be made.

Members who plan to make full withdrawal in any category after the crediting of 2021 dividend the 2021 dividend will be credited into their account on the dividend crediting date. Clause 38 of the Employees Provident Fund Scheme 1952 fixes the time limit for making payment in respect of contribution to the provident fund to be 15 days from the close. The last date to pay final installment of advance tax payment for Financial year 2020-21 is March 15th 2021.

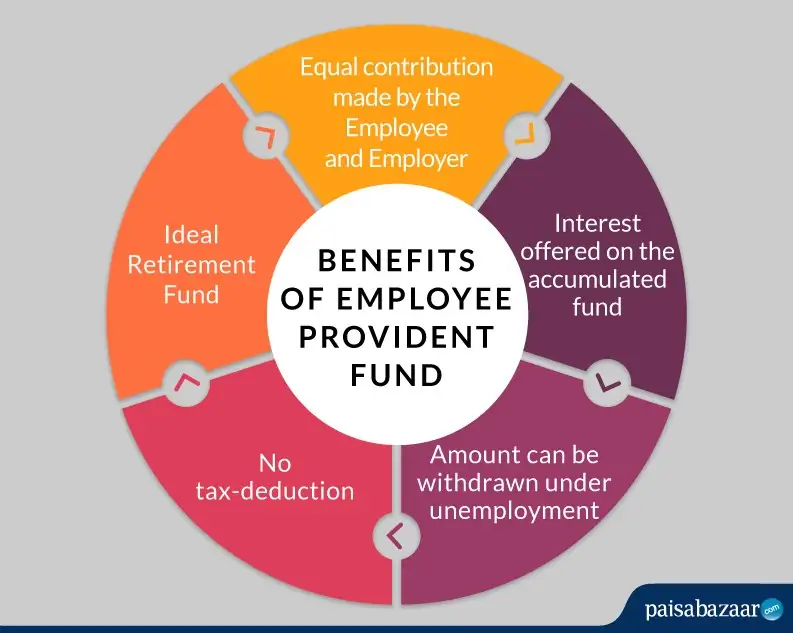

So if your EPF account has a minor name or date of birth mismatch have it fixed as soon as possible. EPF create wealth give regular income as a pension secure familys future saves taxes. The report shows thousands of the PF accounts are dormant for as the owners have new accounts due to the shifting of employment.

Late Payment Penalty in EPF. You can updatechange your name date of birth and gender in your PF account both online and offline. When withdrawals are made in 2022 they are eligible to receive withdrawal payments together with dividends at the rate of 2021 for the period of the savings are in.

Who are liable for EPF SOCSO and EISs Contribution. However the due date of PF return and the due date of PF payment are both the same ie. EPF members can claim 75 of their PF amount after 1 month from the date of leaving and the remaining 25 can claim after 2 months.

Withdrawal due to unemployment. This should be done on or before the 15th of every next month. In case an individual resigns for its role and remains unemployed for a month one can withdraw 75 of its PF corpus to meet its expenses.

Thus if wages pert. Next verify the following Service Details. Member ID DOJ EPF DOJ EPS DOE EPF DOE EPS and Reason of Leaving.

Stay up to date. It is exempt-exempt-exempt in terms of taxation. Similar to EPF SOCSO contribution will be deducted from both employees and employers funds and will be paid every 15th of each month.

Also it is a low-risk instrument due to government backing offers a pension and is a very convenient saving tool. EPF subscribers need to log in to the official portal of the EPFO using their Universal Account Number UAN. Salary Disbursal Date.

Full time Malaysian employees 48 hours per week part-time employees with working hours between 30 to 70 with the company directors for Sdn. For EPFO portal balance check visit the EPF portal and click on Our Services on the dashboard. Employees Provident Fund.

Establishment of the Board. Installment of Advance Tax Payment Due Date for FY 2020-21. Know about the details of EPF payment online on the Employees Provident Fund Organization EPFO portal.

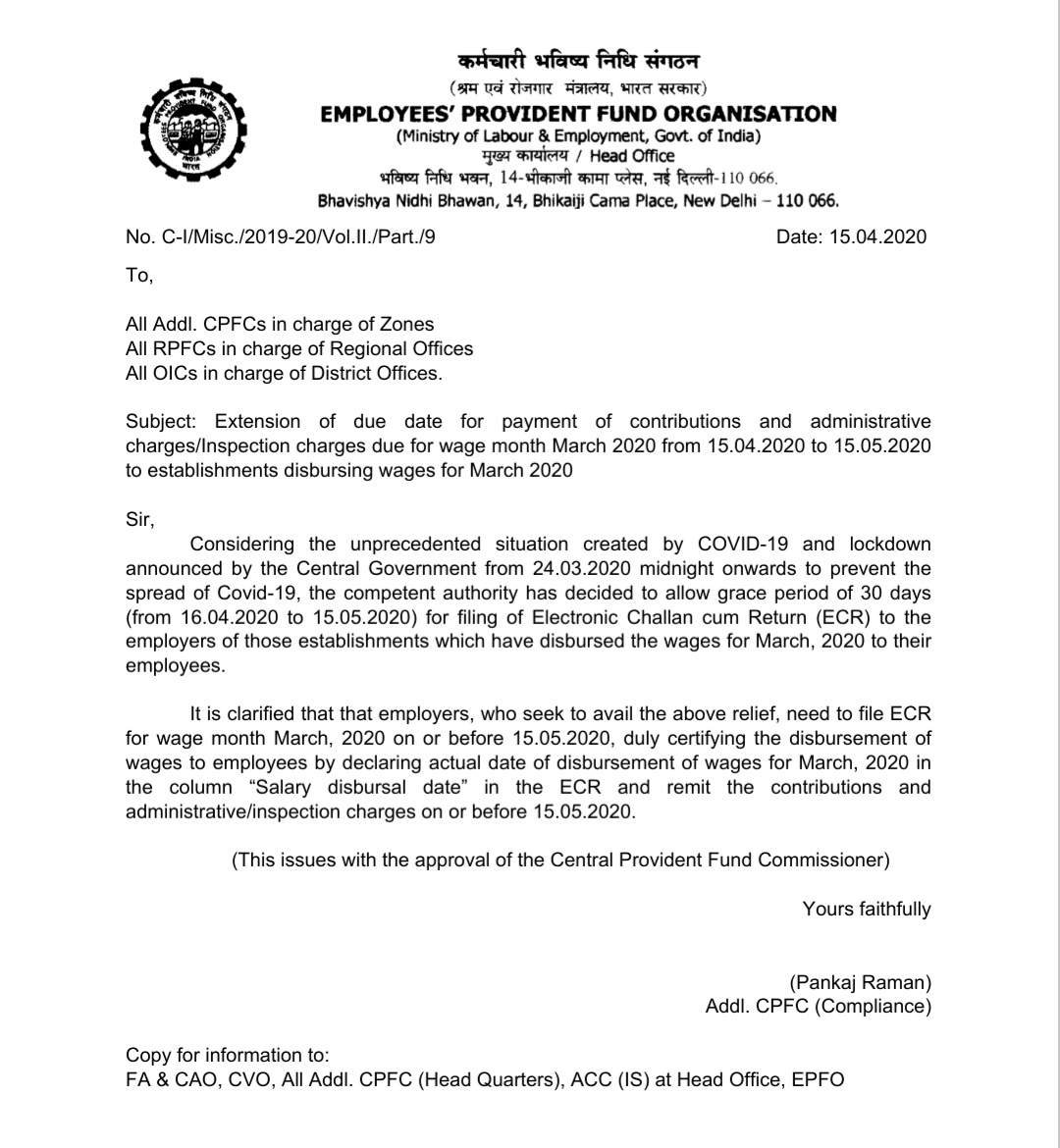

With respect to the exceptional circumstances arising due to the COVID-19 pandemic payment of EPF interest will be split into two parts. To check your PF balance online click on the For Employees button. Due date for payment of Provident Fund contributions is 15 days from the end of month in which wages are paid plus grace period of 5 days.

On this date 100 of advance tax liability has to be paid by taxpayers. Upon the late payment of EPF. It explains how to Change or Correct EPF Details like NameFather NameDate of BirthDate of Joining along with the form.

How to check EPF Passbook balance online. Check EPF Balance through EPF Portal Online Umang App SMS or Missed Call. PART II THE BOARD AND THE INVESTMENT PANEL.

To withdraw the pension amount minimum of 6 months of service is required. You can wait for 2 or 3 days after the date. EPF contributions at PDF copy.

Know how EPF works its eligibility withdrawal rules Return. Payment Liable for EPF Contribution. Employees Provident fund EPF account is issued to all the members one can trace their funds anytime by just access to the account online through the official website page.

Here you will have to verify your bank account number by providing the last 4 digits. EPF members can apply for 100 of their PF claim amount after Two months from the date of leaving their job. For the purposes of managing the Fund and for carrying into effect the purposes of this Act a body corporate by the name of Employees Provident Fund Board is established with perpetual succession and a common seal and which may sue and be sued in its corporate name and.

On or before the 15th of every month. There are a few channels SOCSO have disclosed on where employers may auto deduct from. Listed below is the advance tax schedule for self employed and businessmen.

Jan 13 2022 - 09. Due to the COVID-19 pandemic the Government of India has announced a scheme called Pradhan Mantri Garib Kalyan Yojana PMGKY under which the employer and employee will receive contributions to the EPF account of employees for three months from March 2020 April 2020 and May 2020. Correction of the EPF UAN.

EPF withdrawal is also available in case of unemployment while changing jobs. Claim id-SRSRT180450004561 Member id-SRSRT15681080000010021 has been rejected due to - DATE OF JOINING OF MEMBER IS PRIOR TO COVERAGE DATE OF ESTABLISHMENT PLCLERIFY CORRECT D O JOK. Hello Sir My last working day in the last Organization was 2122022 I joined new company on 2332022 Date of exit is mentioned as 2122022 under the Service history by my last employerI want to go for final settlement but I am unable to see Form 19 option on EPFO websiteI raised a grievance for it and I got a reply stating Date of Exit is not reflecting.

EPF Payment Online on Employees Provident Fund Organization EPFO Portal Updated on. Under the KYC Details section verify your Aadhaar No PAN No Bank Account No IFSC Code and Branch Name Address. PF Balance Enquiry Missed Call Number.

Epf Payment Online Procedure Receipt Download Late Payment Penalty

How To Report Epf And Esi Due Date Extension In Tax Audit Report For Ay 2020 21

Esi Epf Dates Extension In View Of Lockdown A C T S Co

Govt Extends Due Date To File Pf Contribution Returns For The Month Of March 2020

Relief To Establishments From Levy Of Penal Damages For Delay In Deposit Of Epf During Lockdown

Payroll Related Filling Extended Deadlines Due To Mco Yau Co

Esic Department Extends Due Dates For April 2021 Amid Covid Pandemic Taxontips

Pf Payment Due Dates For The Fy 2020 21 For Tax Audit Reporting

Esi Epf Dates Extension In View Of Lockdown A C T S Co

How To Correct Wrong Date Of Exit In Epf Pf Date Of Exit And Date Of Joining Update Epfo Detail Youtube

Deadline For Epf Aadhar Linking Step By Step Guide To Link Uan To Uidai

How To Update Epf Date Of Exit Online Without Employer Basunivesh

Pf Payment Due Date For April 2020 Youtube

How To Update Epf Date Of Exit Online Without Employer Basunivesh

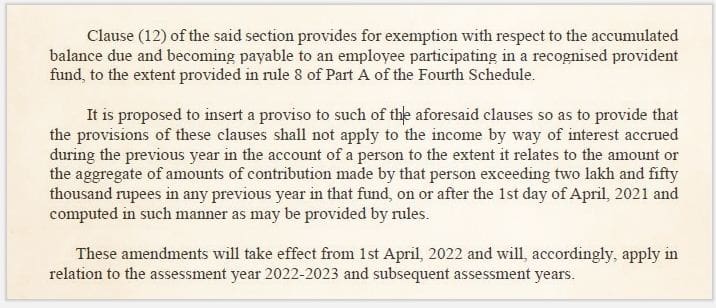

New Epf Rules 2021 Latest Amendments To Epf Act

Relyonsoft Pf Due Date Grace Period For Deposits Is Now Removed

Due Dates Relating To Payroll India Esi Pt Pf Tds

After Epf Withdrawal Claim Status How Many Days To Get Pf Amount

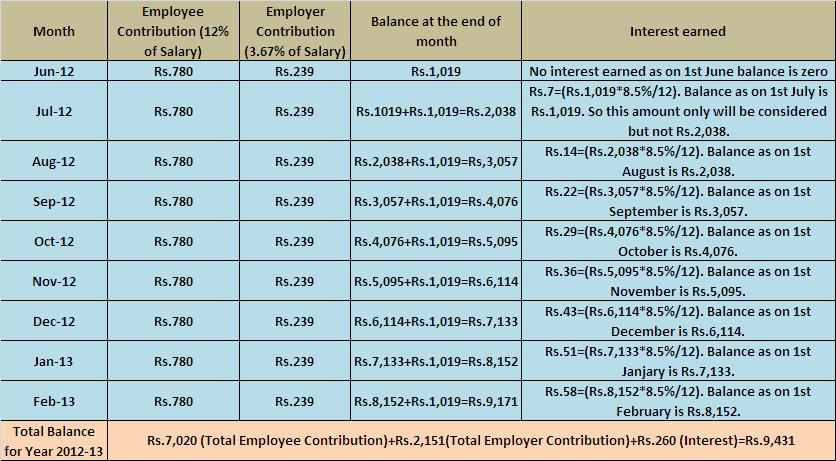

How Epf Employees Provident Fund Interest Is Calculated